How Are Shippers Budgeting for Full Container Loads in 2025?

With global demand softening and capacity normalizing, the 2025 ocean freight market looks very different from the chaos of the past few years. Many logistics teams are rethinking how they approach freight budgeting, especially when it comes to balancing contracted NAC rates with spot market FAK rates.

At Hatfield & Associates, we’re seeing a clear shift in how shippers are managing freight spend and what they’re prioritizing in this new market environment.

1. Shippers Are Challenging Their Own NAC Agreements

During 2023 and 2024, many companies locked in high contracted rates under Named Account Contracts (NACs) to secure space when the market was volatile. Now, those same companies are seeing spot FAK rates that are significantly lower, prompting a strategic rethink.

Instead of sticking with outdated contracts, smart shippers are:

- Evaluating the balance between long-term contracts and spot market opportunities

- Leveraging NVOCCs to access diverse routings and flexible pricing

- Entering renegotiation cycles earlier than planned

2. They’re Splitting Their Volume: Part NAC, Part Spot

Previously, many shippers committed everything to long-term contracts for the sake of predictability. Today, the smarter approach is a split model. A portion of volume is committed to NACs for stability, while remaining capacity is held back to take advantage of better FAK spot rates.

This dual strategy gives shippers:

- Flexibility during low-demand periods

- Cost protection in case of a market rebound

- Leverage in future rate negotiations

3. Budgeting Is Month-to-Month, Not Annual

Forecasting freight costs for an entire year has become increasingly difficult. With geopolitical uncertainty, labor disruptions, and fuel price swings, more companies are budgeting in shorter timeframes like quarterly or monthly.

They are using tools like:

- Real-time rate benchmarks from audit and market platforms

- Scenario planning for seasonal and lane-specific volatility

- Compliance monitoring to ensure the best rate is actually being used

4. Visibility Is Now a Budgeting Tool

Budgeting used to mean applying a percentage increase to last year’s spend. But in today’s market, that approach lacks the precision shippers need.

Teams are now using historical audit data and shipment trends to better understand where spend is concentrated, where contracts are underutilized, and how to shape more accurate forecasts.

5. Some Shippers Are Using This Moment to Rebuild Their Carrier Strategy

With carriers more open to negotiation, shippers who come to the table with data and flexibility are in a strong position. They are:

- Updating volume forecasts with current demand in mind

- Using performance metrics to revisit service expectations

- Bringing audit and routing data to justify new contract pricing

This is a chance to improve both cost and service alignment going forward.

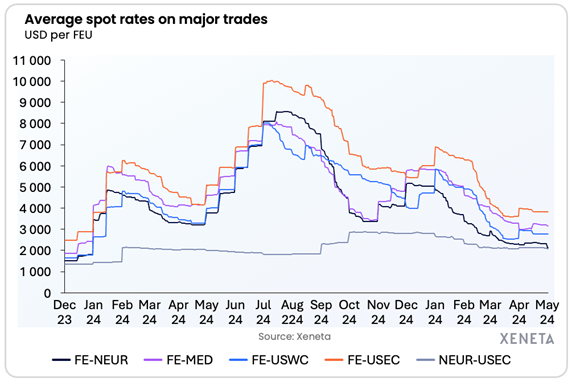

Spot Rate Trends: Xeneta Market Data

This chart from Xeneta shows the sharp decline in spot rates across major trade lanes, including routes from the Far East to North Europe, the Mediterranean, and both U.S. coasts.

The steep drop in late 2024 and early 2025 illustrates why many shippers are questioning existing NAC agreements and moving more volume to the spot market.

Source: Xeneta Ocean Container Shipping Market Update – March 2025

The Bottom Line

Ocean freight budgets in 2025 are no longer built on fixed rates and static forecasts. Instead, successful shippers are adopting flexible strategies. In a market where FAK spot rates can beat NAC contracts, the most effective teams are those that:

- Monitor pricing conditions regularly

- Enforce contracts but adapt when market rates shift

- Use short-term planning cycles to stay nimble

At Hatfield & Associates, we help our clients create freight strategies that are data-driven, flexible, and cost-effective. If you're reviewing your contracts or preparing for RFP season, let’s connect and discuss how we can help.