New Steel Tariffs Are Back: What They Mean for Your Business

Introduction

President Trump has doubled tariffs on imported steel and aluminum from 25% to 50%, effective June 4, 2025. The policy excludes imports from the United Kingdom, which remain at 25% pending further negotiations. While the goal is to protect domestic producers, this move is already sending ripples through the economy (White House Fact Sheet).

Economic Impacts to Watch

The Congressional Budget Office projects the new tariffs will raise the average annual inflation rate by 0.4 percentage points in 2025 and 2026. GDP growth is expected to shrink slightly as a result, with an estimated reduction of 0.06 percentage points per year (CBO Report).

Manufacturers are likely to feel the brunt of these increases. Industries that rely heavily on steel and aluminum, including automotive and construction, face significant cost hikes. Automakers could see vehicle prices jump by $2,000 to $4,000 (CBS News).

Job effects are mixed. While steel industry employment may see a marginal boost, previous data shows that steel tariffs added about 1,000 steel jobs while eliminating around 75,000 jobs in downstream manufacturing (Washington Post).

Beyond GDP and inflation, there is a broader concern about volatility. Businesses with thin margins, such as Tier 2 and Tier 3 automotive suppliers, appliance manufacturers, and regional contractors, may be forced to scale back projects or pass costs to customers.

Sector-Specific Consequences

The construction sector is already seeing the fallout. A recent warehouse project in Newark experienced an 8 to 10 percent spike in steel-related costs, adding roughly $2 million to the overall budget (Washington Post).

Consumer goods will not be spared either. Products like canned foods and beverages are vulnerable since nearly 80% of tin-mill steel used in cans is imported (Recycling Today).

Retailers and distributors may also feel pressure. Shelving systems, fixtures, and imported appliances all carry a steel component, which means pricing changes could ripple through supply chains. Warehousing buildouts and material handling infrastructure could see delays and budget revisions.

Global Response

Canada is considering retaliatory tariffs and taxes, including measures that could affect electricity exports to the United States. These exports currently serve 1.5 million American customers (Reuters).

Trade partners in the EU and Asia are also reassessing their steel import flows. Some manufacturers may divert product to markets with lower barriers, which could create artificial gluts in other regions or incentivize transshipping, where materials are routed through third countries to avoid tariffs. (Reuters).

Market Reactions

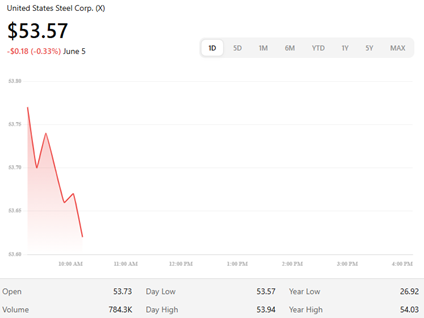

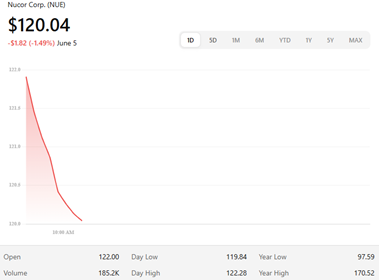

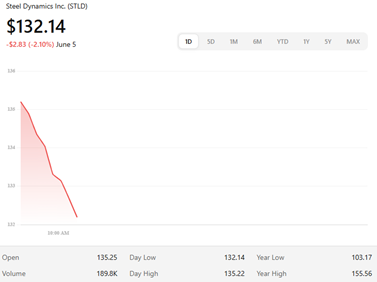

Steel companies showed mixed reactions in the stock market following the announcement:

- United States Steel Corp. (X): Traded at $53.57, down slightly from the previous close

- Nucor Corp. (NUE): Fell to $120.04

- Steel Dynamics Inc. (STLD): Dropped to $132.14

Investors remain uncertain about how sustainable the pricing lift for domestic steelmakers will be, especially if global backlash leads to reduced demand or alternative sourcing strategies from buyers.

How Companies Should Respond

If your company relies on steel-intensive goods, whether in construction, automotive, food production, or logistics, now is the time to act:

- Reevaluate contracts with suppliers for flexibility clauses

- Analyze domestic versus international sourcing options

- Model price sensitivity across key SKUs or projects

- Review freight costs, especially for imported components subject to both tariffs and higher transport fees

- Consider buffer inventory strategies for long-lead steel components

Conclusion

This tariff hike may boost a few domestic producers, but for most businesses, it signals increased costs, supply chain delays, and inflationary pressure. Now is the time to revisit sourcing strategies, review freight contracts, and prepare for cost volatility. If your operations rely on steel or aluminum in any form, waiting to act could be costly.

Need Help Navigating Freight & Tariff Changes?

Let Hatfield & Associates simplify your supply chain. From transportation management to freight auditing, we help businesses cut costs and stay agile.